Bengaluru-based fintech unicorn CRED is in discussions to raise $75 million in an internal round of funding, marking its first capital infusion in nearly two years.

The round, which is set to see participation from existing backers GIC, RTP Global, and Sofina, will come at a sharp reset in the company’s valuation—from $6.4 billion in 2022 to a reported $3.5 billion, sources familiar with the development told YourStory.

CRED last raised $140 million in June 2022 through a mix of primary and secondary transactions led by Singapore’s sovereign wealth fund GIC.

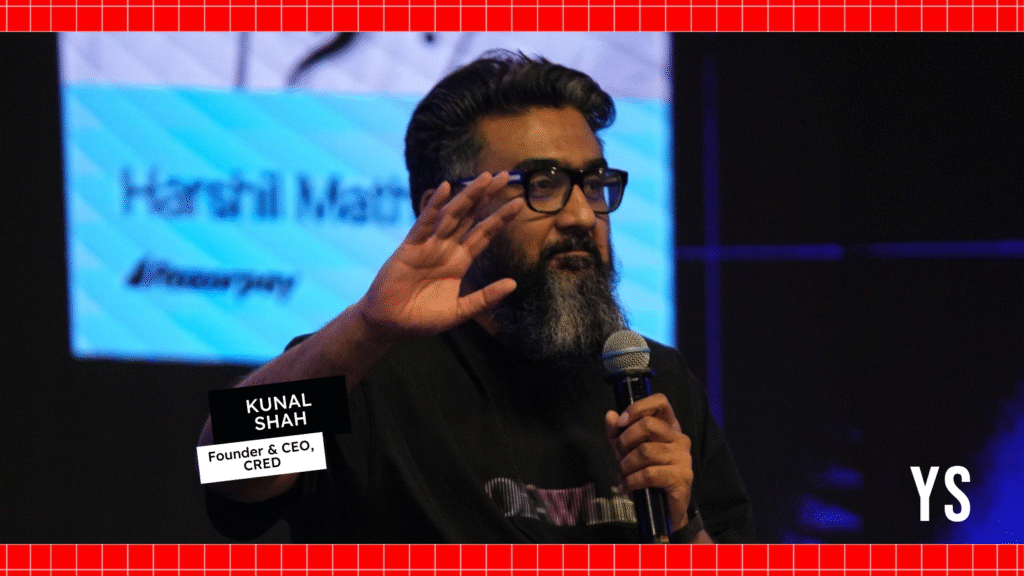

Founder Kunal Shah is expected to invest approximately $20 million in the round, according to an Entracker report, which first reported the fundraise.

Over the past two to three years, the members-only credit card bill payment platform has significantly evolved its business model, diversifying beyond its core offering into new verticals, including wealth management and vehicle-related solutions.

Key to this evolution has been the launch of CRED Garage and CRED Money, alongside strategic acquisitions like that of the wealth management platform Kuvera.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

CRED Garage, introduced in September 2023, is a vehicle management platform designed to simplify car ownership. It offers users a consolidated dashboard to manage various aspects of their vehicles, including documents, FAStag recharge, fuel spend tracking etc.

CRED has now partnered with CARS24 to enable the selling of used cars via its app.

Last year, CRED reported that its total revenue surged by 66% to Rs 2,473 crore in FY24 from Rs 1,484 crore in FY23. Meanwhile, its operating losses narrowed by 41% to Rs 609 crore from 1,024 crore.

CRED’s user base grew significantly in FY24, with a large portion of customer acquisition coming from organic channels. Over 75% of its new users were acquired organically, which helped reduce customer acquisition costs by 40%. The company stated it did not spend big on advertising during the fiscal year.

There was also a substantial increase in the adoption of CRED Pay across online merchants, resulting in a 254% boost in transaction volumes over the year.

Additionally, the platform’s total payment value climbed 55%, reaching Rs 6.87 lakh crore.

Edited by Kanishk Singh