From K-pop and K-dramas to K-toons and K-beauty, there’s a visible Korean cultural wave sweeping across Gen Z and millennials.

Korean street food, an under-penetrated segment so far, has now joined the party and is finding favour among young Indians. And Bengaluru-based QSR (quick service restaurant) brand aims to cash in on this fervour.

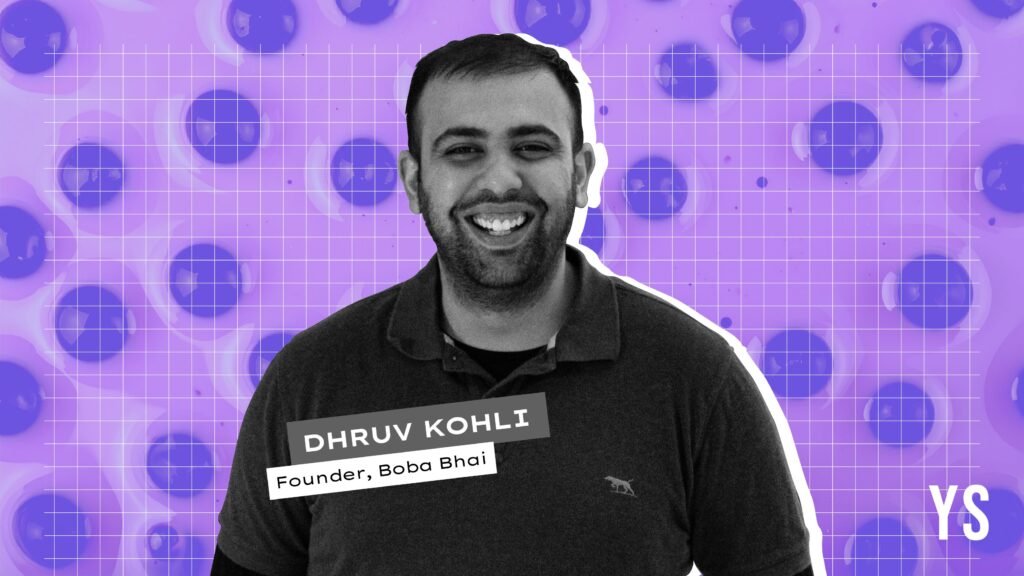

Boba Bhai, which sells Korea-inspired fast food and bubble tea, was founded in 2023 by Dhruv Kohli. Its menu features bold, spicy, and cheesy flavours that echo Korean food trends, tailored to Indian tastes, paired with bubble tea, which is popular in modern Korean cafés and street food spots.

Kohli’s aim is to capture the vibe of Korea’s snacking culture—vibrant, youthful, fast, and fun.

“Everyone was watching Korean shows and listening to K-pop. No one was offering a food experience that matched that excitement. That’s the disconnect we wanted to bridge,” he says.

In just under two years, Boba Bhai has grown to over 60 outlets across nine Indian cities, serving more than 1 lakh orders per month.

The brand’s menu features over 40 SKUs across bubble teas, cold coffees, milkshakes, Korean-style burgers (veg and non-veg), and finger foods like fries, wings, and spring rolls.

It also offers ice creams and desserts inspired by Korean flavours—with options such as strawberry milk, matcha, banana milk, and Korean melon, topped with elements such as popping boba, mochi, and sweet rice cake bits

Building a new format

Kohli isn’t new to the food-tech industry. Before Boba Bhai, he had co-founded Geezy Foods, a virtual kitchen aggregator operating over 500 cloud kitchens across Australia, United Kingdom, and New Zealand. After nearly two decades in Australia, he exited the venture and returned to India in 2023, encouraged by the changing consumer landscape in the country.

“India’s food landscape has evolved dramatically. Global flavours are no longer occasional indulgences—they are part of urban eating habits. Among them, Korean food and aesthetics are rising fast,” he says.

Kohli spent months on-ground, attending K-pop festivals, K-drama fan events, and local pop-ups, to understand the pulse of the people and the cultural traction.

<figure class="image embed" contenteditable="false" data-id="576003" data-url="https://images.yourstory.com/cs/2/6c7d986093a511ec98ee9fbd8fa414a8/BobaBhaifood-1751372105806.jpg" data-alt="Boba Bhai" data-caption="

Boba Bhai’s burger and tea

” style=”float: right; margin-left: 20px; width:50%; height:auto”> Boba Bhai’s burger and tea

“There were thousands of attendees, some fluent in Korean, others trying bubble tea for the first time,” he recalls. “But when it came to food, there was no accessible, reliable brand that served that appetite.”

With a Rs 2 crore personal investment and interest from investors, Kohil began testing the waters through weekend pop-ups in Bengaluru, selling bubble tea and Korean snacks such as spicy fried chicken bites, cheesy corn dogs, and gochujang-seasoned fries.

Encouraged by the response, he launched Boba Bhai’s first delivery kitchens in metro neighbourhoods of Bengaluru, targeting early adopters like urban millennials and Gen Z consumers.

“We didn’t start with expensive flagship stores—we focused on being agile. A delivery-first model let us experiment with menu formats, pricing, and customer preferences without taking on heavy capital risk,” Kohli notes.

This lean experimentation helped Boba Bhai raise a seed investment of Rs 12 crore from Subtrac Capital, Global Growth Capital, and select angels. With this, the brand expanded to Delhi-NCR and Mumbai, and gradually added dine-in outlets to its mix.

Today, the brand operates 60 outlets across nine cities, including Delhi, Mumbai, Bengaluru, and Hyderabad, and is available on delivery platforms such as Swiggy, Zomato, Blinkit, and Zepto.

Korean food with a desi twist

Boba Bhai’s menu is inspired by Seoul’s bold and indulgent street food culture. Instead of sticking to traditional Korean dishes, the brand is reinterpreting popular Korean street foods with Indian fillings such as paneer and aloo tikki.

It has tailored its offerings to suit Indian tastes, under the guidance of Chef Vikram Chawla, formerly with ITC Hotels, who now leads the R&D team at Boba Bhai.

For example, Gochujang Paneer Burger, which blends Korean gochujang sauce with a paneer patty; Cheese Maggi Corn Dog, a twist on the Korean classic filled with masala Maggi and cheese; Loaded Kimchi Fries, combining tangy kimchi with Indian masala fries and spicy mayo; and K-Style Chicken Wings, glazed in a Korea-inspired sweet-spicy sauce, seasoned to match Indian spice preferences.

The products go through trials and evaluations—they make it to the menu only if customer feedback and repeat purchases support that. This approach has helped Boba Bhai clock a monthly volume of over 1 lakh orders.

Boba Bhai’s products are priced between Rs 119 and Rs 249. It clocks an average order value of Rs 400 online and Rs 330 in-store. About 55% of its revenue comes from beverages, mainly bubble teas in 45 flavours including Taro Lava and Banana Milk. The remaining 45% comes from food.

Tech-driven operations

To ensure consistency across its chain, Boba Bhai is relying on automation and systems.

Core ingredients and preparations—such as sauces, marinades, and prepped components—are made in centralised cloud kitchens and commissaries, and then dispatched to each outlet. Final assembly and cooking (frying, grilling, beverage dispensing) are done in each outlet using standardised, semi-automated systems.

The outlets use IoT-enabled fryers, automated dispensers, and standardised cooking systems, such as pre-set grills, portion control tools, and digital recipe workflows—to minimise variation and ensure product quality across locations.

“Our machines know the exact temperature for frying chicken or mixing syrups. It’s a precision-led scale,” says Kohli.

All this ensures quality control, speed, scalability, and minimum staff training, he adds.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

Beyond stores

Earlier this year, Boba Bhai came out with a ready-to-drink canned bubble tea product. With a price tag of Rs 99, a 6-month shelf life, and a spill-proof design, it was created with Gen Z in mind and designed for quick commerce.

<figure class="image embed" contenteditable="false" data-id="576004" data-url="https://images.yourstory.com/cs/2/6c7d986093a511ec98ee9fbd8fa414a8/Cans3-1751372180912.jpeg" data-alt="Boba Bhai" data-caption="

” align=”center” style=”float: left; margin-right: 20px; width:50%; height:auto”>

Launched first on , the product is now available on and Instamart, in 70+ cities; another 180 cities are in the pipeline. The brand has invested Rs 1 crore in the ready-to-drink vertical, which contributes 10% of total revenue. Kohli expects this to touch 40% by FY26.

New SKUs—including Korean chips and sauces, and smaller-sized bubble tea cans for general and modern trade—are under development.

Growth and future potential

In FY25, Boba Bhai posted a net revenue of Rs 30 crore—a big jump from Rs 5 crore in FY24. Dine-in outlets contributed about 20% of this. The company now plans to convert all its 30 cloud kitchens into physical QSRs; the goal is to reach 100 outlets by the end of this fiscal year.

Each of its outlets are company-owned and company-operated, with an average capex of Rs 14 lakh and a 12-14 months breakeven period.

According to Custom Market Insight, the bubble tea market in India is projected to grow from a valuation of $450.1 million in 2024 to $930.1 million by 2033.

Boba Bhai competes with brands such as The Bubble Room, Bubble Bee, and Dr Bubbles in the beverage space, and Seoulmate and Koriko in the Korean-inspired food category

What sets the brand apart isn’t just the menu and recipe, says Kohli. “It’s also the systems and infrastructure. Our focus is on making culturally relevant formats like bubble tea and Korean snacks accessible, consistent, and scalable across cities.”

Boba Bhai recently expanded to Pune through a delivery-only cloud kitchen setup. Going forward, it aims to deepen its presence in Delhi, Mumbai, Chennai, and Hyderabad, and branch into Tier II cities such as Jaipur and Ahmedabad. Simultaneously, the brand also plans to expand its presence across Swiggy Instamart, Blinkit and Zepto.

Boba Bhai has a 4,000 sq. ft. manufacturing facility in Bengaluru. A new, larger unit is being planned to support both QSR and FMCG expansion in the next 5–7 years.

Looking ahead, the brand expects a revenue of Rs 70 crore–Rs 100 crore in FY26, with quick commerce contributing up to 40% of the topline.

Edited by Swetha Kannan