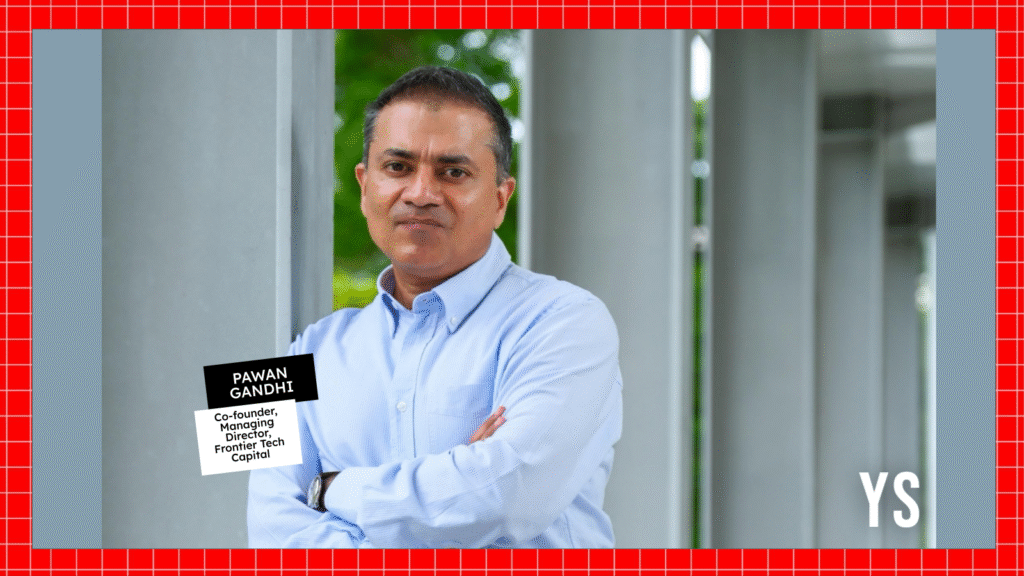

Frontier Tech Capital, a new private equity fund co-founded by Pawan Gandhi, Founder of Singapore-based KaHa, an IoT firm acquired by boAt in 2022; ex-Citi executive Brijesh Pande; and Texas-based Plainview CEO Razat Gaurav, is raising $150 million corpus for its maiden fund.

In an interview with YourStory, Gandhi said the firm has already raised almost half of the targeted corpus, and is now scouting for startups to write its initial cheques, which will be upward of $10 million. The fund aims to invest in between 10 to 15 companies from this fund.

Frontier Tech will look to invest in growth-stage technology and tech-enabled companies that are generating over $50 million in revenue with a number of caveats.

“We also look at the quality of revenue. We are very keen to understand if the company is now operationally kind of profitable? What are the growth prospects? Is the technology something that can be scaled to other parts of the world? So, these are some of the things that we kind of want to understand before we decide on investments, shortlist, and create that funnel,” Gandhi said.

The firm has already set up teams in key Southeast Asian countries with former SoftBank India Country Head, Manoj Kohli, leading the point on Indian investments.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

Frontier’s maiden fund, which has a tenure of eight years to instill deployment of patient capital, is backed by a mix of family offices and institutions with commitments from Japan-based institutions, Singapore-based family offices, as well as from a large pool of UAE-based limited partners, and has seen interest from Indian family offices.

By focusing on Southeast Asian countries, the firm is positioning itself to tap into country-specific technological strengths.

For instance, Gandhi pointed out that Vietnam has produced a number of manufacturing tech and tech-enabled solution startups with a strong operational efficiency, while Thailand has seen significant development in gaming, animation, and creative technology.

However, Frontier Tech is not planning to have a pre-set allocation for each country and is looking to make investments that are purely merit-based with a high focus on scaling these companies abroad. Having said that, Gandhi said, “If I was to look at the funnel, there’s an overwhelming weightage of Indian companies.”

In India, Gandhi pointed out that agritech is a standout sector, and that these companies differ from their counterparts as they don’t get carried by “urban metrics” and are truly focused on profitability. Moreover, “their canvas is much larger and they are trying to make an impact in the country and that impact is significant.”

Edited by Megha Reddy