In 2021, BlackRock’s CEO Larry Fink heralded the advent of a new category of unicorns.

“It is my belief that the next 1,000 unicorns…won’t be a search engine, won’t be a media company, they’ll be businesses developing green hydrogen, green agriculture, green steel and green cement,” he said at the Middle East Green Initiative Summit in Riyadh.

Today, financial institutions like BlackRock no longer look at climate risk as an environmental issue but as a material financial risk. The asset manager, along with Singapore investment firm Temasek, has backed thermal battery maker Antora Energy and ConnectDER which develops technology to streamline distributed energy resources, among other companies.

Then there are unicorns like US-based Commonwealth Fusion Systems—backed by Tiger Global, Temasek, and Bill Gates—working on fusion energy, and Arcadia, which has built a utility and data energy solutions platform.

In India, climate tech startups with the potential to become unicorns are missing. Despite the initial excitement, innovation has been slow and funding abysmal, except for electric vehicle makers.

“We saw a low more excitement in this sector during the first phase of growth post the COVID-19 pandemic,” says Sambitosh Mohapatra, Partner and leader, climate and energy at PwC India. “We thought after the first phase, there would be a jump up where people will actually start investing in the technology to take it forward, that has not happened yet.”

According to experts, the sluggish growth in India’s climate-tech segment can be traced to low demand, a conservative approach to the sector by other countries, and the lack of stringent local regulatory policies.

“Climate is what you’ll broadly call a commons problem, which essentially means it’s no individual’s problem. It is something that we jointly own as a problem,” says Ankit Jain, CEO and co-founder at StepChange. The company provides ESG (environmental, social, and governance) management and reporting solutions for enterprises and financial solutions.

In a price-conscious market like India, where consumers are not focused on sustainable means and the cheapest item on the shelf wins, companies are less motivated to spend on sustainable supply chains, giving rise to a free-rider problem.

The free-rider problem also extends to countries. As benefits from climate change mitigation spill beyond national borders, there is a strong incentive for nations to free ride at the expense of others.

“There was an expectation that the Global North would transition and fund the Global South when it comes to climate-tech. It has never happened,” Mohapatra of PwC notes.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

The uphill climb for climate-tech startups

Since 2022–the year that saw an uptick in startup funding—486 startups in the climate tech sector have received funding across multiple rounds from Indian venture capital firms and angels.

However, a closer look at these numbers shows that a majority of the funding has been concentrated at the early stage, where the cheque size is typically smaller.

According to data website Tracxn, in 2022, around 287 startups raised early-stage funding, which includes Seed and Series A. This declined to 251 in 2023 and 222 in 2024. However, it is pertinent to note that while fewer startups raised funding, the cheques being written at each round saw a jump, indicating a maturing ecosystem where investors have stepped up their criteria to back emerging companies in the space.

Less than one-tenth of these companies manage to secure follow-on capital.

“In India, there’s a lot of early-stage capital available to back innovation. But unfortunately, as the innovation scales, there’s not enough growth capital available in India. So it’s easy to back a company that’s looking for a $2 or $3 million ticket size, because there are tons of VCs who are happy to do that. There’s also a lot of family offices now that are willing to invest directly into climate in the early stage,” according to Sandiip Bhammer, Founder and co-managing partner at Green Frontier Capital, a US and India-based venture capital firm that invests in clean-tech and sustainability startups.

Bhammer has a point. In 2022, only 26 startups raised growth-stage capital, which includes Series B and Series C cheques. In 2023, this dipped to 22, and in 2024, it was 24 companies.

But not all sectors within the climate-tech umbrella have gone unnoticed.

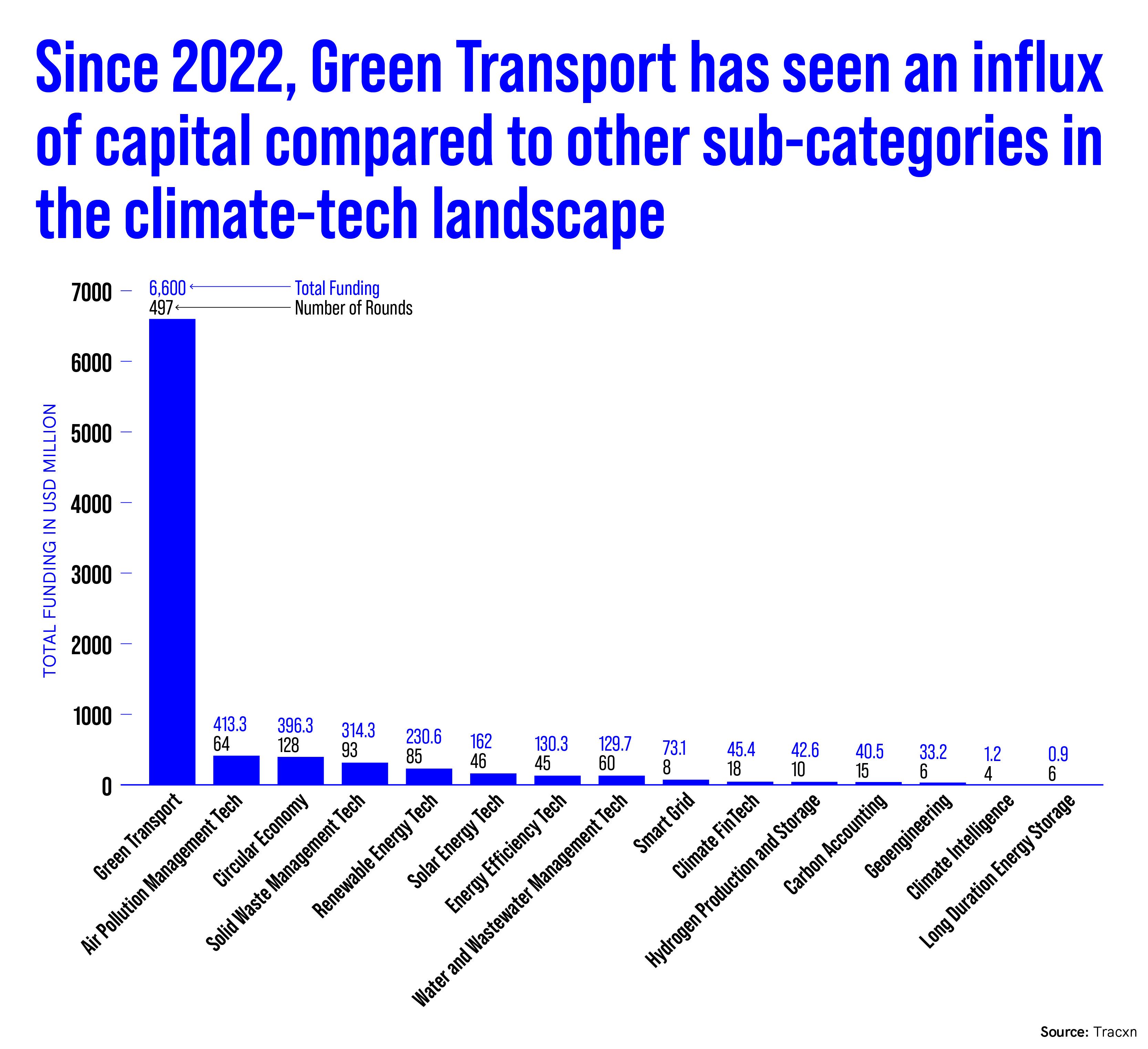

Since 2022, a whopping $6 billion has gone into funding startups operating in electric vehicles, battery technology, and other transition vehicles. The influx has resulted in the creation of two unicorns in the mobility segment alone: EV-makers Ola Electric and Ather Energy.

According to Bhammer, this interest in mobility transition is purely based on returns. “The returns on investments in these sectors are the fastest.”

<figure class="image embed" contenteditable="false" data-id="576867" data-url="https://images.yourstory.com/cs/2/c2cedff02d6111ef9021856619e24ca1/IMG0567-1752408916398.jpeg" data-alt="Green transport funding" data-caption="

Green transport has seen a large influx of funding due to quick returns from this sector

” align=”center”> Green transport has seen a large influx of funding due to quick returns from this sector

Few takers for climate tech

The other hurdle in India’s climate tech or green tech ecosystem is policy.

The country has been slow to set up an infrastructure that would reinforce businesses to focus on sustainability. While the Securities and Exchange Board of India has mandated the top 1,000 companies in the country to publish ESG (environmental, social, and governance) reports in the form of a Business Responsibility and Sustainability Report (BRSR), experts point out this is a very small step when compared to global peers.

For instance, failure to publish BRSR reports does not implicate any monetary penalties for these companies. In comparison, Europe has penalties and legal consequences for companies that do not comply with ESG guidelines, which include fines of between 10,000 and 5 million pounds (about Rs 11 lakh to Rs 57 crore).

In India, the report covers three ESG pillars: environmental, such as energy use and emissions, social issues, such as employee welfare and diversity, and governance, which includes board independence, audit controls, and grievance redressal.

“When we were building a software for ESG, we divided these principles into nine disciplines. We found that out of these nine disciplines, seven disciplines are more along the lines of presumptions questions and encouraging qualitative data. It’s not quantitative data. Qualitative data is a sentence. It cannot be ever brought into scrutiny,” said Sapna Nijhawan, CEO and co-founder at Sustainiam. The company provides carbon emission management solutions and trading platforms.

With the government policies not being timely, sustainability becomes a choice for companies. Also, most companies do not want the extra cost burden, “Any new technology, once it starts, is very pricey and then it needs its time of stabilisation before it becomes price-competitive,” says Arpit Dhupar, CEO at Dharaksha Ecosolutions.

This puts the companies in a pickle. Those opting for expensive and sustainable practices might see a spike in their capital expenditure, which will eventually be passed on to the consumer. This is especially worrisome in a price-sensitive market like India.

Avaana Capital-backed Dharaksha develops and manufactures biodegradable packaging materials using agricultural waste. According to the company’s website, it counts consumer goods company Dabur and direct-to-consumer dairy brand Baroda as its clients.

“Indian consumers are very price-conscious. So they are not loyal to a particular brand nor are they loyal to initiatives taken by a company. So if there are, let’s say, five products on the shelf, the cheapest product gets sold. Companies cannot risk adopting a pricier initiative, be it in packaging or be it in any other form of sustainability, that increases the unit price of the product. Ultimately, consumers might reject it on the shelf. So that’s a huge risk for the companies and they are very cautious with changing anything in the supply chain,” Dhupar adds.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

For instance, according to a research report published by Deloitte, more than half of the surveyed consumers in the UK were willing to pay a premium for brands that align with their environmental values. Whereas in India, consumers still value low prices over sustainability.

This has encouraged UK-based companies like Unilever to implement ethical sourcing to reduce its plastic footprint.

The potential for climate technology is huge—the Indian green technology and sustainability market size is expected to reach $8.6 billion by 2033 with a compound annual growth rate of 27.36% during 2025 to 2033, according to a 2024 report by consulting services provider IMARC.

“Indian exchanges are still in the collection phase when it comes to implementing an ESG structure for companies…our adoption is still starting. We were fifteen years too late to this but the government is working on understanding the industries and prioritising on what sector they should focus on,” said Sustainiam’s Nijhawan.

For now, the ecosystem’s wait-and-watch approach towards climate tech has made the adoption of sustainable practices an uphill battle.